Supreme Court STRIKES DOWN Biden's $400 billion student loan forgiveness: Justices rule president does not have authority to cancel debt of millions in another landmark ruling

Six justices ruled Biden should have got approval from Congress for huge plan. Plan would have eradicated $10K in debt for borrowers earning less than $125K

By James Franey and Kelly Laco

Daily Mail

June 30, 2023

The Supreme Court has struck down President Joe Biden's $400 billion student loans forgiveness plan in another bombshell decision.

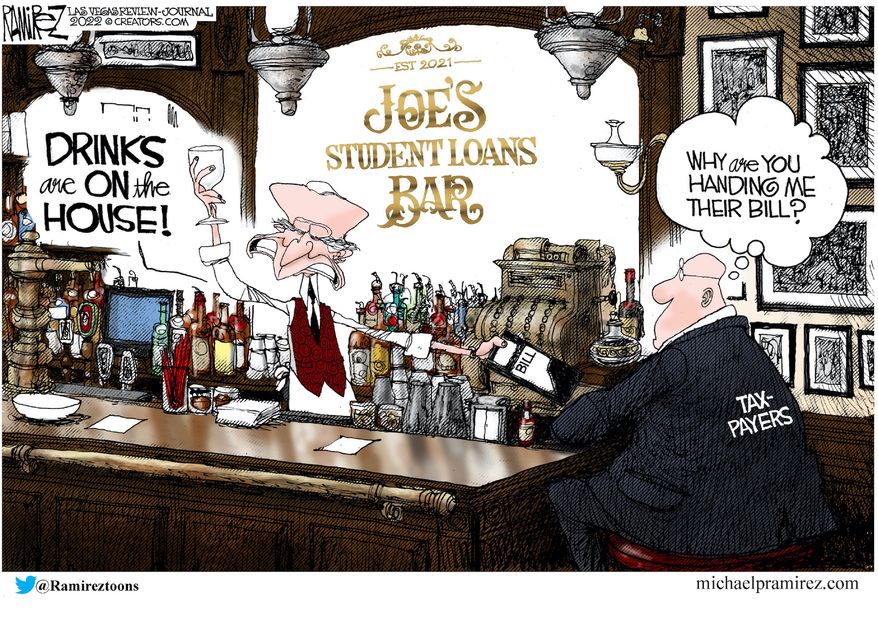

The Supreme Court has struck down President Joe Biden's $400 billion student loans forgiveness plan in another bombshell decision.The justices ruled 6-3 Biden's controversial plan to wipe out debts for 26 million Americans at taxpayers' expense was unconstitutional and an overreach of his executive power.

The landmark ruling on the final day of the Supreme Court's term comes 24 hours after the justices decided colleges could no longer use race as a consideration in admissions in a case that sparked backlash from Biden.

The plan would have eradicated $10,000 in debt for borrowers earning less than $125,000 and up to $20,000 for those with Pell Grants.

But it was challenged by six Republican states and two borrowers who argued Biden should have sought approval from Congress for a plan using substantial taxpayer funds.

Chief Justice John Roberts agreed and said in the majority opinion that a move 'requires that Congress speak clearly before a Department (of Education) Secretary can unilaterally alter large sections of the American economy.'

President Biden called the decision 'disappointing' and 'wrong' and vowed to fight back in a statement released hours after the ruling came down.

The Supreme Court has struck down President Joe Biden's $400 billion student loans forgiveness plan in another bombshell decision. The justices ruled 6-3 against Biden's controversial plan to wipe out debts for around 20 million Americans

'This fight is not over. I will have more to announce when I address the nation this afternoon.

'My Administration’s student debt relief plan would have been the lifeline tens of millions of hardworking Americans needed as they try to recover from a once-in-a-century pandemic.

'Nearly 90 percent of the relief from our plan would have gone to borrowers making less than $75,000 a year, and none of it would have gone to people making more than $125,000. It would have been life-changing for millions of Americans and their families.

'And it would have been good for economic growth, both in the short- and long-term. The hypocrisy of Republican elected officials is stunning. They had no problem with billions in pandemic-related loans to businesses – including hundreds of thousands and in some cases millions of dollars for their own businesses.

'And those loans were forgiven. But when it came to providing relief to millions of hard-working Americans, they did everything in their power to stop it.

'While today’s decision is disappointing, we should not lose sight of the progress we’ve made – making historic increases to Pell Grants; forgiving loans for teachers, firefighters, and others in public service; and creating a new debt repayment plan, so no one with an undergraduate loan has to pay more than 5 percent of their discretionary income.

'I believe that the Court’s decision to strike down our student debt relief plan is wrong. But I will stop at nothing to find other ways to deliver relief to hard-working middle-class families. My Administration will continue to work to bring the promise of higher education to every American.'

Rooberts, in his opinion, went on to say that the HEROES Act, which the Biden administration cited as justification for the plan, actually provides 'no authorization for the Secretary's plan' and therefore there was no clear congressional authorization.

Millions of Americans haven't had to repay their loans for three-and-a-half years because of a COVID pandemic freeze. Borrowers will have to restart their payments in October, and interest will start recurring in September.

Biden's loan forgiveness has been a cornerstone of his presidency, and the ruling will be a massive blow to the administration that has fought against the piling debt. The president is expected to address the nation regarding the ruling later Friday.

For months, Biden's student loan blueprint has been at the center of a legal tussle with six Republican-controlled states and two borrowers. Iowa, Arkansas, Kansas, Missouri, Nebraska and South Carolina said he had no legal authority to go ahead with the plan without the sign-off from Congress first.

Biden used the 2003 post-9/11 HEROES Act as justification for the program. It stipulates the Department of Education can waive student debt during a national emergency.

But in the majority opinion written by the chief justice, said the HEROES Act was not a legitimate basis for the plan.

'Congress did not unanimously pass the HEROES Act with such power in mind,' writes Roberts, saying such decision of 'such magnitude and consequence' on a matter of 'earnest and profound debate across the country' must go through Congress itself.

Former President Trump's Education Secretary Betsy DeVos told DailyMail.com in a statement following the decision that 'everyone knew the debt scheme was illegal,' including Biden himself.

'Today, the Supreme Court simply agreed. The President cannot spend taxpayer money without Congressional approval.'

The former secretary said the 'ploy' by the Biden administration was also 'deeply unfair to the majority of Americans who don't have student loans, and equally concerning, would have only exacerbated the problem of ever-rising college tuition.'

House Speaker Kevin McCarthy, R-Calif., added in a tweet that Biden 'must follow the law.'

'President Biden's student loan giveaway is ruled UNLAWFUL. The 87% of Americans without student loans are no longer forced to pay for the 13% who do.

He also added 'I agree with her for once!' referring to a statement by former House Speaker Nancy Pelosi, D-Calif., from July 2021 that the majority opinion cited.

'People think that the President of the United States has the power for debt forgiveness,' said then-Speaker Pelosi. 'He does not. He can postpone. He can delay. But he does not have that power. That has to be an act of Congress.'

The majority went on to rebut the liberal justices' dissent, in which the Democrat-appointed justices argued student loans are in the education secretary's 'wheelhouse.'

The majority opinion fires back, saying that in 'light of the sweeping and unprecedented impact of the Secretary's loan forgiveness program, it would seem more accurate to describe the program as being in the 'wheelhouse' of the House and Senate Committees on Appropriations.'

Roberts addressed a recent trend of criticism of the Supreme Court's decisions in a fiery standout line from the opinion.

'It has become a disturbing feature of some recent opinions to criticize the decisions with which they disagree as going beyond the proper role of the judiciary,' states Roberts on behalf of the majority.

He went on to defend their conclusion, saying 'precedent— old and new—requires that Congress speak clearly before a Department Secretary can unilaterally alter large sections of the American economy. We have employed the traditional tools of judicial decisionmaking in doing so.'

'Reasonable minds may disagree with our analysis—in fact, at least three do,' the opinion states, referring to the three dissenting justices - Kagan, Sotomayor, and Jackson.

''We do not mistake this plainly heartfelt disagreement for disparagement. It is important that the public not be misled either. Any such misperception would be harmful to this institution and our country.'

The COVID national emergency in the eyes of the government came to an end in May 2023.

The Supreme Court was asked to rule on the scheme after a federal court issued an injunction freezing the forgiveness plan

The program has been on hold since November after a federal appeals court in St. Louis, Missouri, issued an injunction pausing applications and payouts.

That forced the government to seek the intervention of the Supreme Court justices.

The six conservative justices expressed their skepticism of the plan during oral arguments in February, and gave an early indication of their decision.

Announced last August, the administration vowed to cancel some $10,000 in federal student debt for students earning less than $125,000.

Officials also promised to axe an additional $10,000 for students who received what are known as Pell Grants.

These financial aid payments are awarded to students with exceptional financial needs.

But most Republicans say those who took out loans need to repay them without a bailout. They have also argued that taxes paid by Americans who didn't attend college shouldn't be used to fund those who did.

The Senate recently passed a motion to repeal Biden's loan forgiveness plan, but the president vetoed it earlier in June.

Over 26 million people have already applied for the program, with as many as 16 million having already been provisionally approved for debt relief, according to the Department of Education.

Student debt is the second-largest kind of consumer debt in the U.S. behind mortgages and other home loans.

Nationwide, 45 million Americans owe $1.6 trillion in borrowed cash that they used to pay for their college education.

ADDENDUM:

No comments:

Post a Comment