BlackRock pushed back on Texas' decision to pull $8.5 billion in investment from the asset manager over ESG policies

BlackRock pushed back on Texas' decision to pull $8.5 billion in investment from the asset manager over ESG policies.

The world's largest asset manager, BlackRock, is pushing back on Texas' decision to withdraw roughly $8.5 billion in assets belonging to the Texas Permanent School Fund (PSF) over what the state says is a boycott of energy companies.

Texas State Board of Education Chairman Aaron Kinsey on Tuesday announced that the PSF would withdraw funds to comply with a 2021 state law that seeks to prevent the state's public funds from being managed by financial institutions that boycott the oil and gas sector. Kinsey said that "BlackRock's destructive approach toward the energy companies that this state and our world depend on is incompatible with our fiduciary duty to Texans."

BlackRock Vice Chairman Mark McCombe responded to Kinsey in a letter reviewed by FOX Business in which he wrote that the firm was "dismayed by your announcement" and said the decision puts "short-term politics over your long-term fiduciary responsibilities."

"We urge you to reconsider your decision and prioritize Texas schools and families who have benefited from BlackRock's consistent, long-term investment outperformance," McCombe wrote. He added that BlackRock has delivered "consistently strong performance for Texas PSF" over nearly two decades.

"Our international mandate outperformed Texas PSF's own benchmark since our partnership began in 2006 — generating in excess of $250 million for Texas PSF — with competitive fees. Fiduciaries should prioritize performance and fees when executing their duty," McCombe added.

He went on to dispute the state of Texas' finding that BlackRock boycotts oil and gas companies, saying that the company is in compliance with the law cited as precipitating the PSF pulling its funds from the firm.

"We fully comply with Texas law and fundamentally disagree with your assessment based on BlackRock's performance for Texas PSF and our investments in Texas energy companies. Additionally, Senate Bill 13 makes clear divestment is not required when a government entity determines divestment is inconsistent with its fiduciary responsibilities," he explained. "The outperformance BlackRock has demonstrated shows divestment would not be in the best interest of Texas PSF."

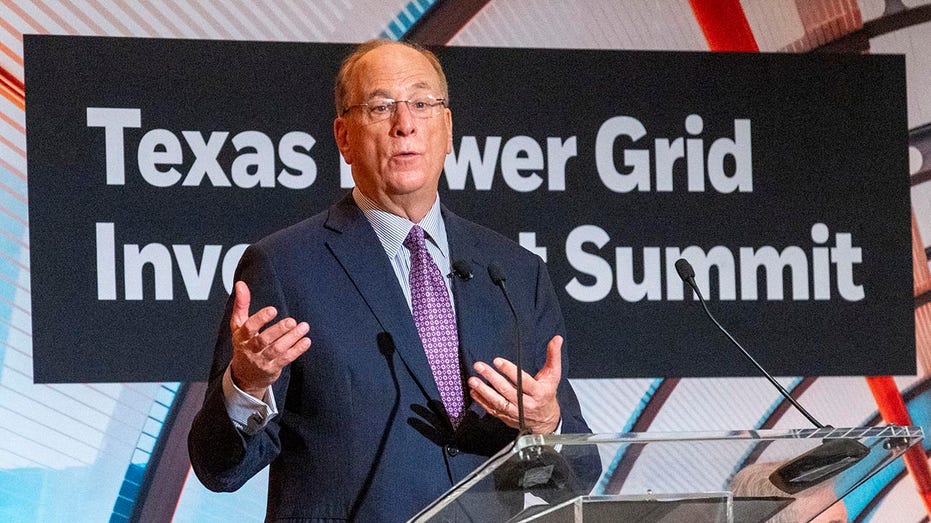

BlackRock, led by CEO Larry Fink, disputed that the company boycotts oil and gas companies and said that the Texas PSF should be more transparent about how it arrived at the decision to pull its $8.5 billion investment.

McCombe also took issue with the manner in which Texas PSF informed BlackRock of the decision and wrote that "the process by which this decision was reached remains unclear to the public."

"We learned of your decision to end Texas PSF and BlackRock's 18-year relationship through a press release. Ending a long, successful partnership that's been a positive force for thousands of Texas schools and families in such a reckless manner is irresponsible," he explained.

"We've come to learn that not all Texas PSF board members were made aware of your decision before it was announced and did not have an opportunity to ask questions or share views," McCombe wrote.

"How our clients invest and whom they entrust to manage their money is entirely their decision, but we feel an action of this magnitude warrants transparency and consensus — not political-driven decision making. Texas schools and families deserve that."

1 comment:

Don't Mess with Texas. (ABC)

Post a Comment